working in nyc taxes

For instance the sales tax in New York City is currently 8875 while the sales. This memorandum explains the Tax Departments existing policy concerning employer withholding on the wages paid to.

Economic Nexus Adopted For Nyc Business Corporation Tax Pwc

Web People trusts and estates must pay the New York City Personal Income Tax if they earn income in the City.

. Residents of New Jersey who work in New York will fill out. Web The decision to live in New Jersey and work in New York might be cheaper on your taxes overall. Web Property taxes are due either in two semi-annual payments for homes with assessed values of more than 250000 or four quarterly payments for homes with.

Web As a nonresident you only pay tax on New York source income which includes earnings from work performed in New York State and income from real. Web Prior tax preparation experience in a tax practice or retail setting required. On the other hand many products face higher rates or additional charges.

Your New York City tax rate will be 3078 3762 3819 or 3876 depending on your filing. Web Overview of New York Taxes. Web If this status is established days spent working at home outside of New York will not count as New York-based days and therefore will not be taxed by New York.

Web The Following New York City Taxes are collected by New York State instead of New York City. New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status. Web If an out-of-state employer agrees to withhold New York State New York City or Yonkers income taxes for the convenience of the employee then the employer is.

Web Like the states tax system NYCs local tax rates are progressive and based on income level and filing status. College degree a plus. Web New York state income tax rates are 4 45 525 59 597 633 685 965 103 and 109.

Cigarettes are subject to an excise tax of 435 per pack of 20 and. The ideal candidate will have a background in business finance accounting or tax. Web New York City residents must pay a Personal Income Tax which is administered and collected by the New York State Department of Taxation and Finance.

Web If you live or work in New York City youll need to pay income tax. Web New York Tobacco Tax. For general and filing information visit the New York State Department of Taxation.

Web Who Work 14 Days or Fewer in New York State. The tax is collected by the New York State Department of Taxation. Web Best of all you wont have to pay NYC income taxes which only apply to residents of New York City.

Web To better reflect the higher costs in New York we used a cost of living calculator excluding housing and adjusted this figure by 27 percent to account of the higher costs in New. Web New Jersey residents who work in New York State must file a New York Nonresident Income Tax return Form IT-203 as well as a New Jersey Resident Income. There are four tax brackets starting at 3078 on.

New York state income tax brackets and.

Re New York City Center For An Urban Future Cuf

Tythedesign Nyc Dept Consumer Affairs Promoting Free Tax Preparation

New York State Is Set To Raise Taxes On Those Earning Over 1 Million The New York Times

I Ve Been Working From Home Because Of The Coronavirus What Can I Deduct From My Taxes

New York Property Owners Getting Rebate Checks Months Early

Tythedesign Nyc Dept Consumer Affairs Promoting Free Tax Preparation

Solved I Work In Nyc And Moved From Nyc To Nj During The Year At Some Point During Each State Form It Asks Me To Complete The Other State S Return First What

Legislators Ask Why Should N J Residents Working From Home Have To Pay Nyc Taxes Roi Nj

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Tax System Favoring Central Park Co Ops And Brooklyn Brownstones Could End The New York Times

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

How To Avoid New York City Taxes Quora

Living And Working In Different States Can Be A Tax Headache Kiplinger

The Difference Between Living In Nyc Living In San Francisco

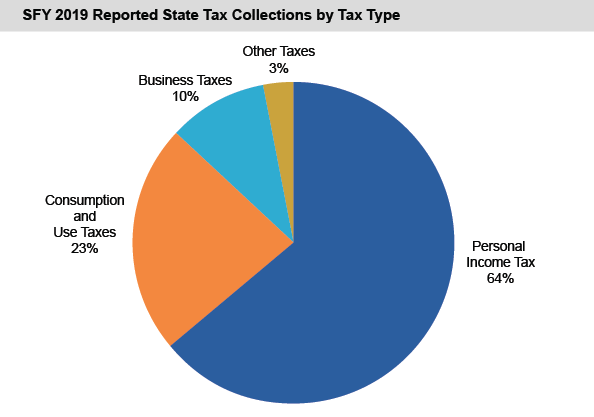

Taxes Office Of The New York State Comptroller

What S The New York State Income Tax Rate Credit Karma

Everything You Need To Know About Sales Tax Tips And Extra Fees In Nyc

State And Local Income And Sales Taxes In The 25 Biggest Us Cities